All of the Following Are Types of Fidelity Bonds Except

Fidelity bonding is one branch of the surety business. Fidelity Bond for Condominium and Home Owners Associations COAsHOAs California Homeowners Association Fidelity Bond Mandatory Coverage Florida COA HOA Fidelity Bond Mandatory Coverage Fidelity Bond for Carpenters Construction Trades.

:max_bytes(150000):strip_icc()/WherecanIbuygovernmentbonds2_2-1cb612f48ed44f169ed689b998d3a2d9.png)

Where Can I Buy Government Bonds

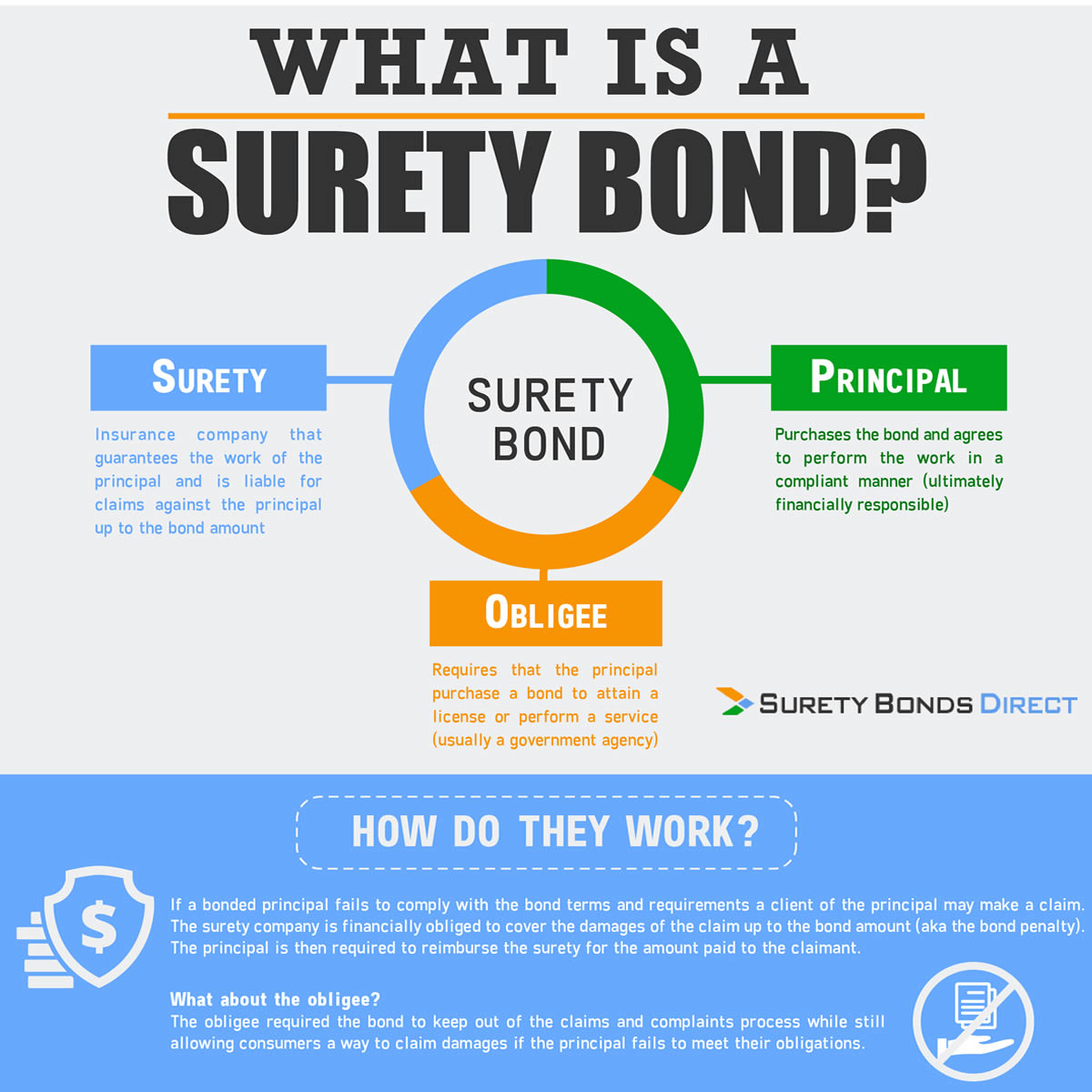

B The surety has the legal right to recover a loss payment from the defaulting principal.

:max_bytes(150000):strip_icc()/WherecanIbuygovernmentbonds2_2-1cb612f48ed44f169ed689b998d3a2d9.png)

. A Right of salvage. Generally the minimum bond amount is 1000. 24 All of the following statements about a surety are true EXCEPT A A surety theoretically expects no losses to occur.

Securities and Exchange Commission. The process of a neutral third party making a decision on a disputed claim is called. Investment-grade refers to bonds rated Baa3BBB- or better.

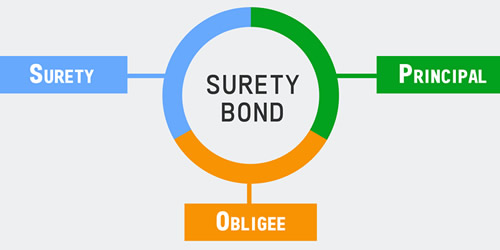

A plain vanilla bond is a bond without unusual features. 24 C There are three parties to a surety bond. Standard employee dishonesty bonds.

Different Types of Bonds Plain Vanilla Bonds. Some types of fidelity bonds may be mandated for businesses to obtain. A blanket position bond B.

A zero-coupon bond is a type of bond with no. Rule 17g-1 g Fidelity Bond Filing for. A Minimizes the possibility of employing persons with dubious records in positions of trust.

You need to have a high risk tolerance to invest in high-yield bonds. ERISA Fidelity Bonds FAQs What is a fidelity bond. Employees are seldom asked to enter into a written agreement to perform their duties honestly but there is an implied contract that employees will act in the best interest of their employers.

Which of the following Employee Fidelity Bonds would cover all employees. It is also known as a straight bond or a bullet bond. All of the following are true EXCEPT A.

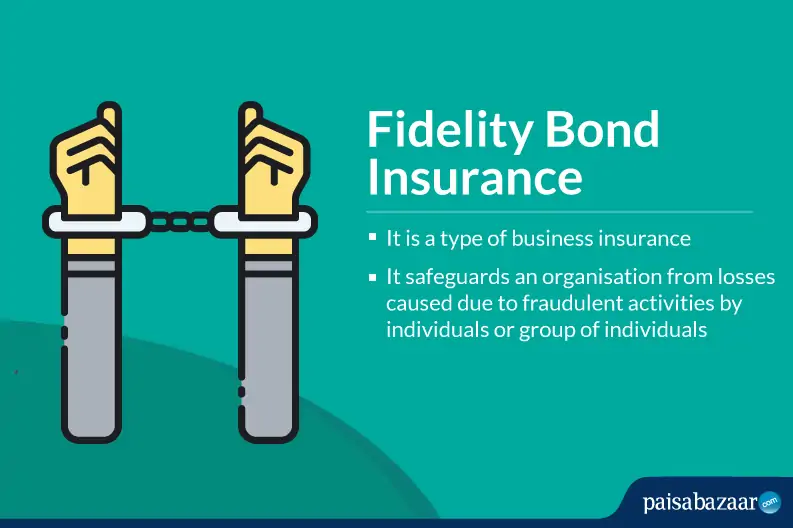

First-party fidelity bonds protect businesses against intentionally wrongful acts fraud theft forgery etc committed by employees of that business. B Reduces the companys need to obtain expensive business interruption insurance. Also known as a surety bond a fidelity bond is a special type of insurance that protects a company-sponsored retirement plan from losses due to misuse or misappropriation of plan assets by a plan official.

By being familiar with the different types of surety bonds that are available youll be better prepared when a situation arises in which you need the protection a surety bond provides. Probably the most common kinds of actions that would be covered. It is one of the simplest forms of bond with a fixed coupon and a defined maturity and is usually issued and redeemed at face value.

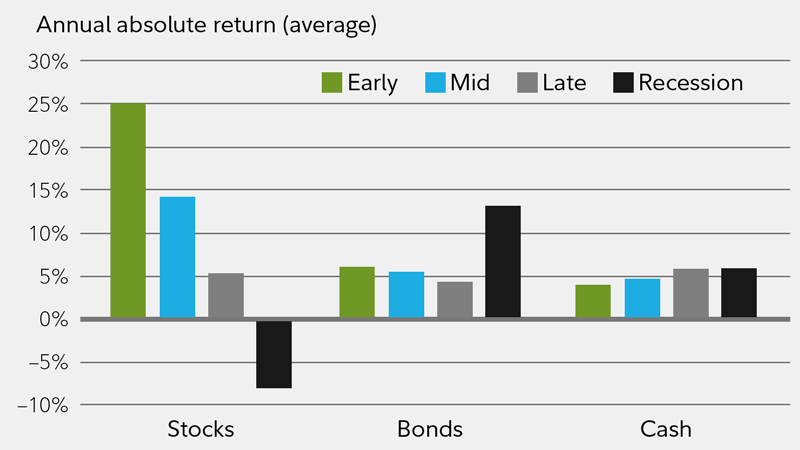

The bond amount is based on plan assets. Fidelity Bond Filed Pursuant to Rule 17g-1 g 1 of the Investment Company Act of 1940 40-17g March 29 2022 - 0228PM. Investors typically group bond ratings into 2 major categories.

A bond is not required if the owner is the only participant. An individual bond. Regardless of which type of bond is needed a surety bond is almost always obtained from a professional bonding company.

The insured is reimbursed for payroll that continues after the loss begins. The owner of a business would purchase a bond from a brokerage a bonding company or an insurance company as a hedge against suffering significant losses due to fraudulent employee actions. C Court Bond.

At maturity fixed income investments return the principal. C Allows the company to substitute the fidelity bonds for various parts of internal control. Fixed income investments generally provide a return in the form of fixed periodic payments.

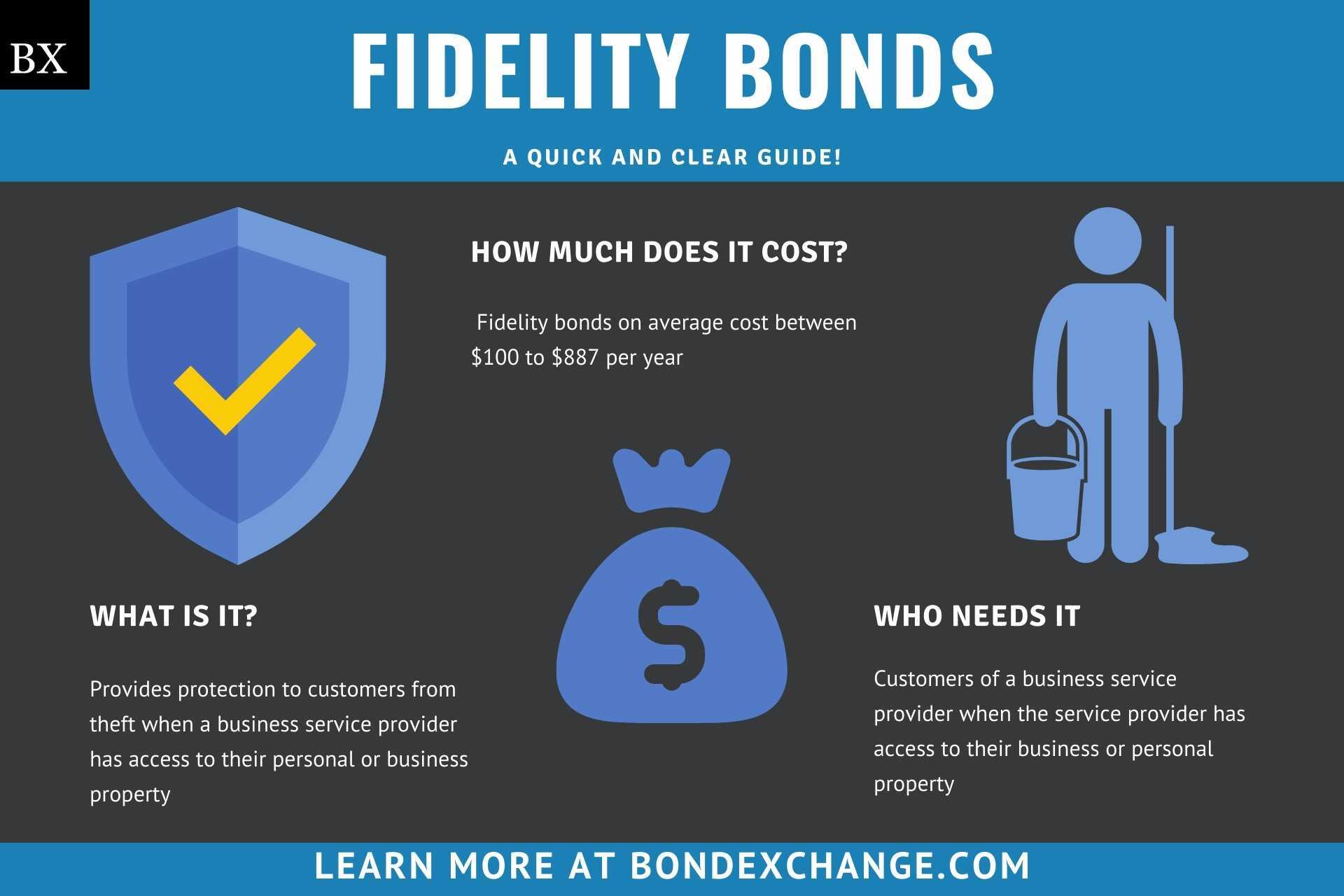

Business services bonds protect against the loss of a customers money equipment supplies and personal belongings caused by dishonest acts of your employees while on the customers premises. How Fidelity Bonds Work. Generally the maximum bond amount is 500000.

Trading BondsFixed Income Securities. Third-party fidelity bonds protect businesses against intentionally wrongful acts committed by people working for them on a contract basis eg consultants or independent contractors. The principal the surety and the obligee.

In practice these bonds work very much like an insurance policy. D The principal is the party who agrees. All the following types of property are covered by a standard builders risk form EXCEPT.

All of the following are types of Fidelity Bonds except. A Fidelity Bond is an insurance policy that protects companies against financial loss due to employee fraud and theftFidelity Bonds are also called Employee Dishonesty Bonds or Business Service Bonds though these are technically different types of Fidelity BondsYour clients from theft by your employeesOr both. Protecting the companys retirement plan assets can require fidelity bonds in the event an employee gains access to and.

Types of fidelity bonds. All of the following statements regarding fidelity bond requirements are TRUE EXCEPT. Like all bonds a fidelity bond guarantees a contract made between two parties.

The use of fidelity bonds protects a company from embezzlement loses and also. Fidelity Bond for Financial Advisers ERISA Compliant Fidelity Bond for Property Management Companies. Edgar US Regulatory March 29 2022.

D Position Schedule Bond. A Individual Bond. 100 F Street NE.

B Blanket Bond. High-yield also referred to as non-investment-grade or junk bonds pertains to bonds rated Ba1BB and lower.

What Is An Employee Dishonesty Bond

Fidelity Bond Insurance Coverage Claim Exclusions

Buy Fidelity Bonds Compare Quotes Costs 2022

Tips And Investing In Inflation Fidelity

Construction Companies 5 Must Have Types Of Insurance For Your Business

What Is A Fidelity Bond A Comprehensive Guide By Bondexchange

Financial Institution Bonds Lance Surety Bonds

Buy Fidelity Bonds Compare Quotes Costs 2022

What Is A Surety Bond Surety Bonds Explained

What Is A Surety Bond Surety Bonds Explained

Construction Companies 5 Must Have Types Of Insurance For Your Business

Construction Companies 5 Must Have Types Of Insurance For Your Business

The Business Cycle Equity Sector Investing Fidelity

Fidelity Bonds Employee Dishonesty Coverage Advisorsmith

What Is A Fidelity Bond A Comprehensive Guide By Bondexchange

Construction Companies 5 Must Have Types Of Insurance For Your Business

:max_bytes(150000):strip_icc()/savings-bonds-vs-cds-which-better-2016.asp_V1-4754e38f62f64fc7bb19a06de61c8817.png)

Comments

Post a Comment